Garmin Edge Touring Plus Fahrrad Navigationsgerät, ANT+ Schnittstelle, bis zu 15 Std. Akkulaufzeit, frei wählbare Datenfelder, 2,6 Zoll (6,6 cm) Touchscreen-Display : Amazon.de: Elektronik & Foto

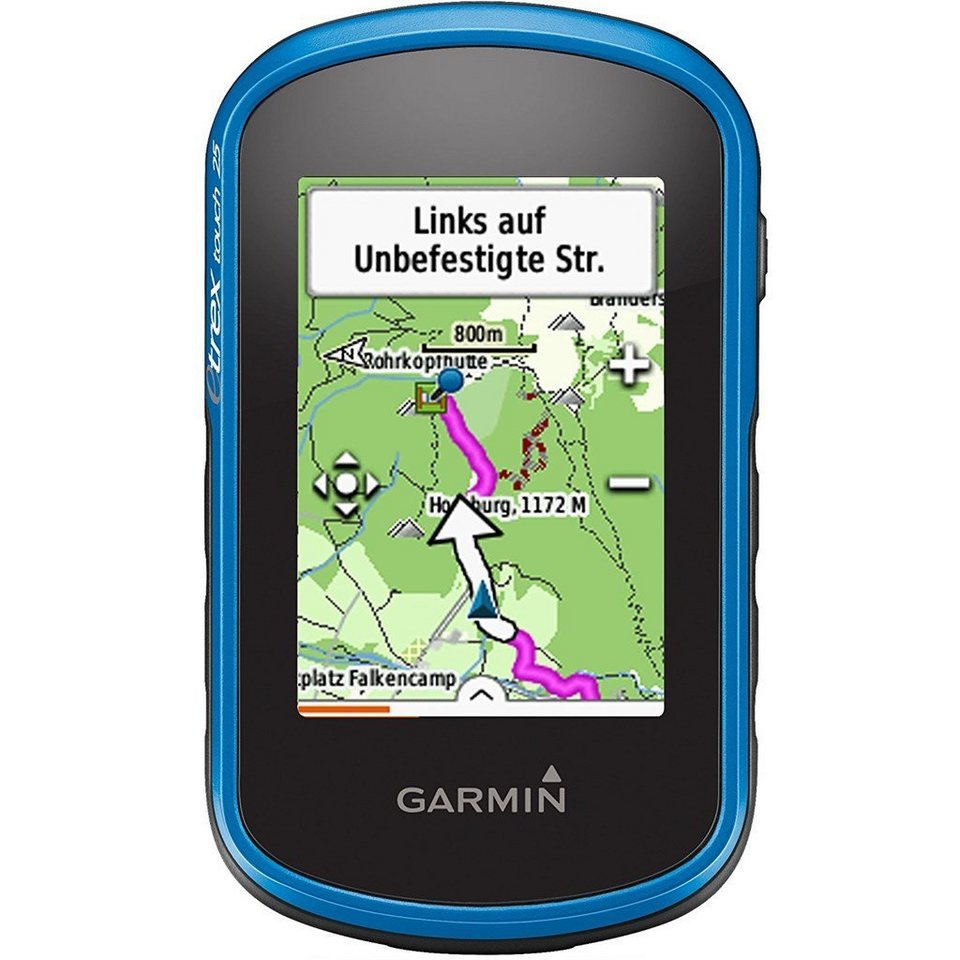

Garmin Fahrrad-Navi eTrex 25 Touch 010-01325-01 | Sonstiges | Telefone & Mobilfunk | Technik & Zubehör | Buschmann Büromaterial - Büroeinrichtung - Bürotechnik - 170 Jahre Erfahrung im Büro

GARMIN Edge 800 Halterung Karte Fahrrad GPS Navi Navigationsgerät in Berlin - Köpenick | Fahrrad Zubehör gebraucht kaufen | eBay Kleinanzeigen

![Fahrrad Navi Test 2022: Welches bringt dich ans Ziel? ▷ [Kaufberatung] Fahrrad Navi Test 2022: Welches bringt dich ans Ziel? ▷ [Kaufberatung]](http://planet-fahrrad.de/wp-content/uploads/2018/05/garmin-edge-1030-test-600x383.jpeg)